Mexico’s Cold Supply Chain Heats Up with Demand for Temperature-Controlled Logistics

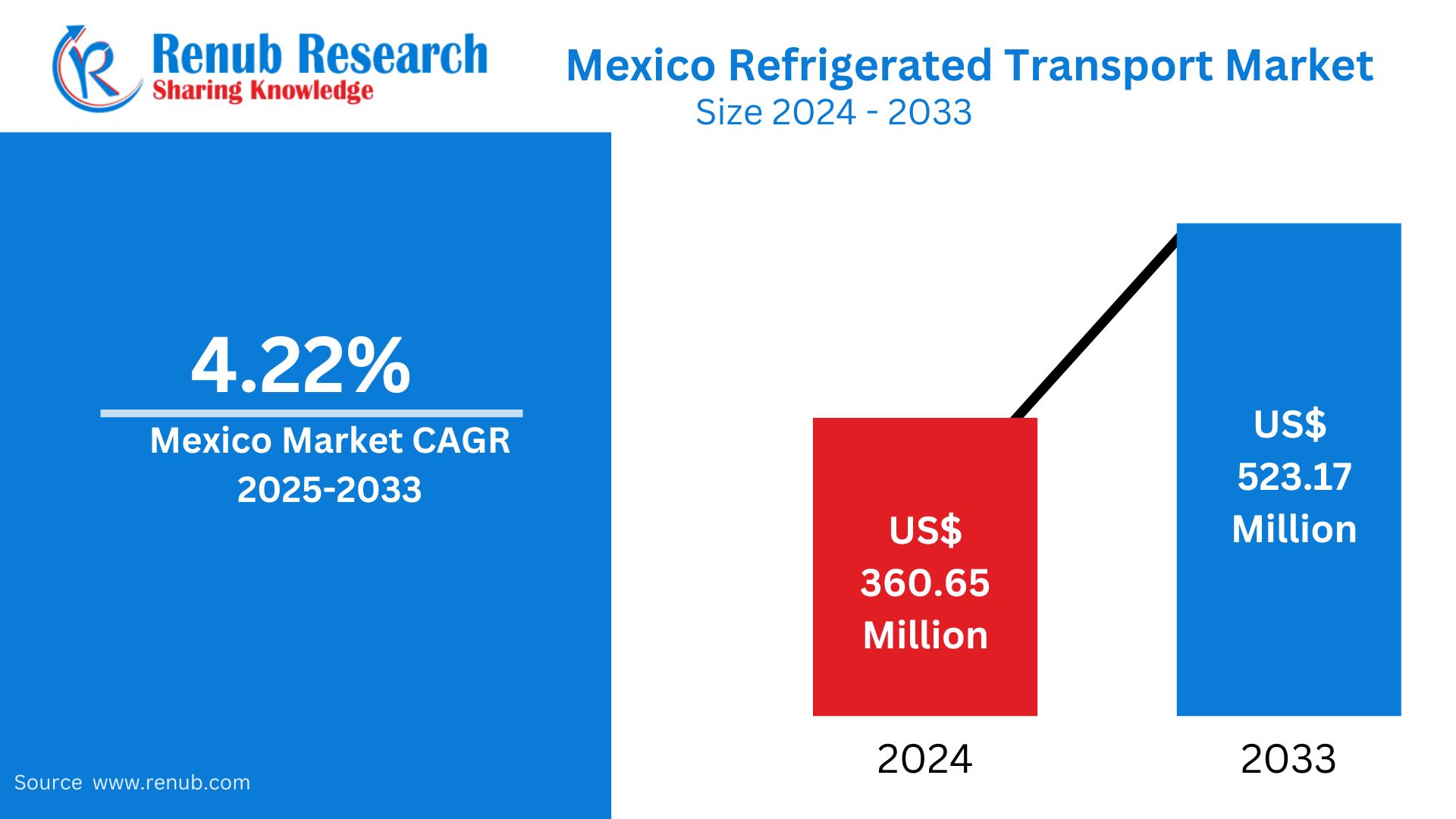

According to Renub Research, the Mexico Refrigerated Transport Market is poised for robust expansion, projected to grow from US$ 360.65 million in 2024 to US$ 523.17 million by 2033, registering a CAGR of 4.22% from 2025 to 2033. This growth is propelled by the escalating demand for perishable goods, expanding pharmaceutical exports, and advancements in refrigeration technologies.

Rising Perishable Goods Trade and Consumer Demand Fuel Market Growth

The surge in demand for fresh fruits, vegetables, dairy, seafood, and meat has significantly influenced the need for efficient refrigerated logistics in Mexico. Urbanization and rising disposable incomes have shifted consumer preferences toward high-quality, fresh, and processed foods.

Mexico’s thriving agribusiness sector and its strategic geographic position as a trade hub with the U.S., Latin America, and beyond further reinforce the expansion of refrigerated transport infrastructure. Cross-border trade of perishable commodities, particularly with the United States, continues to surge, necessitating enhanced cold chain systems.

Pharmaceutical Sector: A Major Driver in Cold Chain Expansion

Another critical contributor to market expansion is the pharmaceutical industry, especially the increase in production and export of temperature-sensitive drugs and vaccines. The COVID-19 pandemic underscored the importance of reliable cold storage and transport for biopharmaceuticals, and that demand continues in the post-pandemic environment with Mexico becoming a major player in pharma logistics.

Technological Advancements in Refrigeration and Monitoring

Emerging refrigeration technologies have significantly improved the efficiency and eco-friendliness of refrigerated transport. The integration of IoT, telematics, and real-time temperature monitoring is enabling logistics providers to offer higher reliability, reduced spoilage, and compliance with international safety standards.

Environmental Regulations and Sustainable Transport Solutions

As global and national policies tighten on emissions, there is increasing pressure on logistics providers to adopt green technologies. Hybrid refrigerated trucks, electric reefer units, and solar-assisted refrigeration are becoming prominent in Mexico’s transport sector, aligning with sustainability goals.

Market Segmentation Analysis

By Mode of Transport:

- Road transport remains the dominant segment due to Mexico’s extensive highway network and domestic distribution needs.

- Rail and air refrigerated transport are emerging, especially for long-distance or international shipping of high-value perishables and pharmaceuticals.

- Sea transport continues to be significant for global exports of frozen produce.

By Application:

- Food & beverages account for the largest share, led by demand from supermarkets, hypermarkets, and food service chains.

- Pharmaceuticals and healthcare applications are rapidly increasing, as precision cold-chain compliance becomes crucial for drug safety.

- Others include floral, chemicals, and industrial goods needing temperature control.

By Region:

- Northern Mexico—driven by U.S. border trade, warehousing, and maquiladoras.

- Central Mexico—the industrial and population center with increasing cold-chain infrastructure investments.

- Southern Mexico—emerging slowly, supported by agriculture exports and government investments in logistics.

Key Companies Operating in the Market

Major logistics and transportation companies are investing heavily in modern refrigerated fleets and technologies to cater to the rising demands of Mexico’s cold-chain ecosystem. Key players include:

- Thermo King

- Carrier Transicold

- Mabe Refrigeration

- DHL Supply Chain

- Lineage Logistics

- Grupo Traxión

- Mexicold

- Frialsa

These companies are deploying smart fleet management, AI-driven route optimization, and energy-efficient cooling systems to gain competitive edge.

📈 Market Trends Shaping the Future

1. Shift Toward Multi-Temperature Trucks

To cater to mixed-product loads, carriers are deploying multi-zone vehicles, enabling varied temperature conditions within a single shipment.

2. Digital Cold Chain Solutions

IoT sensors and AI-based predictive analytics are being used to track and optimize load temperatures, delivery timelines, and fuel consumption.

3. Last-Mile Refrigerated Delivery

E-commerce growth in groceries and pharmaceuticals is pushing logistics firms to invest in last-mile cold delivery systems.

4. Public-Private Partnerships

Government initiatives to develop smart logistics hubs and modern refrigerated storage facilities are providing momentum for infrastructure development.

5. Export Growth & Free Trade Agreements

The U.S.-Mexico-Canada Agreement (USMCA) and other trade pacts are supporting growth in cross-border cold-chain logistics.

🔟 Frequently Asked Questions (FAQs)

1. What is the current size of Mexico’s refrigerated transport market?

As of 2024, the market is valued at US$ 360.65 million, according to Renub Research.

2. What is the projected market size by 2033?

The market is projected to reach US$ 523.17 million by 2033.

3. What is the expected CAGR from 2025 to 2033?

The market is expected to grow at a CAGR of 4.22% during this period.

4. Which sectors are driving the demand for refrigerated transport in Mexico?

Food & beverages, pharmaceuticals, and agriculture are the major sectors.

5. What technologies are enhancing cold-chain logistics?

IoT, real-time tracking, AI-based optimization, solar-powered reefers, and hybrid engines.

6. What is the dominant mode of transport in the market?

Road transport dominates due to flexibility and cost-efficiency in domestic logistics.

7. How are government policies influencing the market?

Supportive policies for logistics infrastructure, clean transport, and cross-border trade are helping the sector grow.

8. Is last-mile refrigerated delivery gaining traction in Mexico?

Yes, especially due to the boom in online grocery and pharmaceutical orders.

9. What challenges does the market face?

High capital costs, lack of uniform cold-chain infrastructure in rural areas, and stringent compliance requirements.

10. Who are the major players in this market?

Some major companies include Thermo King, Carrier Transicold, DHL, Frialsa, Grupo Traxión, and Mexicold.

🌐 Discover More:

Access the detailed report with forecasts and insights by visiting:

👉 Mexico Refrigerated Transport Market Report 2025-2033

New Publish Report:

\UAE Meat Snacks Market Size and Share Analysis – Growth Trends and Forecast Report 2025-2033

🏢 📊 About the Company

📌 About the Company: Renub Research

Renub Research is a Market Research and Consulting Company with more than 15 years of experience, especially in international Business-to-Business Research, Surveys, and Consulting. We provide a wide range of business research solutions that help companies make better business decisions.

We partner with clients across all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our wide clientele includes key players in Healthcare, Travel & Tourism, Food & Beverages, Power & Energy, Information Technology, Telecom & Internet, Chemicals, Logistics & Automotive, Consumer Goods & Retail, Building & Construction, and Agriculture.

Our core team comprises experienced professionals with graduate, postgraduate, and Ph.D. qualifications in Finance, Marketing, Human Resources, Bio-Technology, Medicine, Information Technology, Environmental Science, and more.

📞 Media Contact:

Company Name: Renub Research

Contact Person: Rajat Gupta, Marketing Manager

Phone No: +91-120-421-9822 (IND) | +1-478-202-3244 (USA)

Email: rajat@renub.com